Dean Daniel Pullin and Frost Bank Chairman and CEO Phillip Green discussed the importance of customer relationships and company culture in an increasingly digital world.

May 06, 2022

By Nicholas Ferrandino

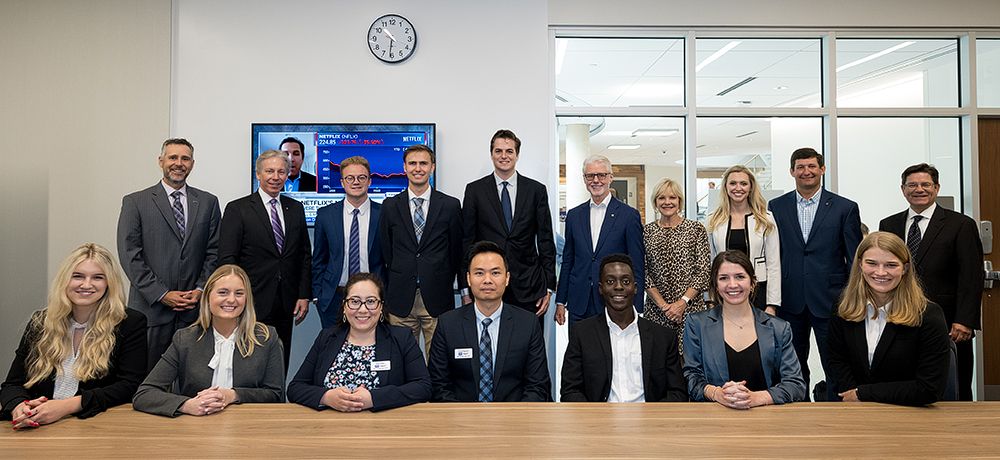

On April 20, the TCU Neeley School of Business hosted a Tandy Executive Speaker Series event featuring Phillip Green, chairman and CEO of Frost Bank since 2016, and employee since July 1980. Daniel Pullin, John V. Roach Dean of the TCU Neeley School of Business, joined Green on stage for the final event in this year’s speaker series.

Together, Green and Pullin discussed how the growing shift toward online and mobile banking systems has reshaped the landscape of finance and employee/customer relations in the banking industry, and what Frost Bank has done to adapt and evolve with it.

To begin, Frost Bank has invested in cryptocurrencies and has developed its own online app, designed specifically for an easy, reliable user experience. The bank is also utilizing advanced online platforms to collect and organize data on a scale that would have been impossible for a firm of Frost Bank’s size to manage in the past.

“These new developments give us the opportunity to curate the absolute best technology in the marketplace, providing our customers with a beneficial value proposition and experience,” Green said.

Innovation is a facet of the human experience that has and will always continue to change the banking industry. But no matter how advanced these technologies become, Green stresses that the customer will always highly value a firm they can trust. That is why Frost Bank focuses primarily on providing a positive customer experience.

“At Frost, we approach technology through an empathetic customer lens,” Green said. “It’s not about the arms race. It is about great technology that allows our employees to respond to customers’ needs.”

Green stresses that while technology is important, the true determining factor of a company’s success is its relationship with its customers. When a company helps its partners succeed, the bank benefits as well.

For example, when the federal government opened the Paycheck Protection Program (PPP) in 2020 to help businesses through the pandemic, Frost Bank used the program to distribute billions of dollars-worth in loans to small businesses across the Dallas-Fort Worth metroplex.

“At one point in DFW, Frost was No. 1 as far as the number of dollars loaned through PPP 2,” Rod Washington, Frost Bank’s Dallas regional president said in an interview with the Dallas Express. “We are proud of the fact that our folks work really hard to get dollars to our customers.”

To provide an empathetic customer experience, Frost Bank has invested a great deal in attracting new talent to their firm. The bank provides scholarship and grant money to renowned universities, including TCU Neeley, and offer a wealth of internship programs as a means of both training and recruiting prospective future employees.

“You have to help people to succeed,” Green said. “We did all of these great things not because we’ve got buildings and lease obligations, but because we have great people.”

Looking forward, Green reiterates that building interpersonal relationships between its employees and clientele will always remain Frost Bank’s central focus. Because no matter how far technology may advance, “people still want people who care about you as a person,” Green added.